I Sold Everything and Went All-In on Crypto — Here’s Why I Believe the Top Isn’t In and 2026 Will Shock Everyone

I sold my house. I emptied my savings. I pushed every last dime—literally everything I own—into crypto.

Not because I’m reckless. Not because I’m chasing a dream. But because I have deep, data-driven conviction that the top is nowhere near in… and that we’re heading much, much higher into 2026.

Right now, the market is dumping. Crypto Twitter is panicking. Analysts who swore we’d never drop this far are suddenly silent.

But I believe the correction is almost over—and that we’re on the edge of a breakout that will define this decade.

In this article, I’ll walk you through:

-

Why the market is falling right now

-

Why I believe this cycle is not a 4-year cycle—but the first ever 5-year cycle

-

Why the “real bull run” hasn’t even started yet

-

And why 2026 could be the biggest crypto year in history

Let’s break it down.

Why I’m Betting EVERYTHING Crypto Heads Higher Into 2026

The Market Is Dumping—But Not for the Reasons Most Think

Most people think this correction is a sign the bull market is over. It’s not.

This dip is the product of three forces happening simultaneously:

1. Structured Institutional Bid – Not Retail FOMO

The entirety of this cycle so far—late 2022 through 2025—has been driven not by retail mania, but by ETF flows:

-

Boomers allocating 1–3% via financial advisors

-

BlackRock’s historic ETF approval

-

Pension managers dipping into Bitcoin for the first time

-

Advisors giving their clients BTC exposure for the first time ever

This is slow, steady, cold money. It is NOT emotions. It is NOT mania. It is NOT euphoria.

Meanwhile, retail?

Retail hasn’t shown up yet.

And every past parabolic blow-off top—2013, 2017, 2021—was driven by retail mania fueled by massive year-over-year liquidity expansion.

This cycle has had none of that.

2. We’ve Been In a Tightening Cycle Since 2022

Historically, every major crypto bull cycle aligns with explosive liquidity growth.

This time?

-

Global tightening

-

Record rate hikes

-

Balance-sheet contraction

-

Tariffs

-

Credit stress

-

Treasury issuance flooding markets

-

The RRP (Reverse Repo Facility) drained to zero

-

TGA rebuild sucking liquidity out

-

A record-long U.S. government shutdown cutting off the biggest spending faucet in America

This has been the tightest liquidity environment in 40+ years.

And yet Bitcoin STILL pushed to all-time highs.

Imagine what happens when easing returns.

3. Fear of the 4-Year Cycle Is Causing Forced Selling

A lot of people believe 2026 will be a “down year” because past cycles topped the year after halving.

So they’re selling in 2025 to “get ahead” of the downtrend.

But selling early creates the downtrend.

This is how cycles break.

As one analyst put it:

“People believe 2026 will be a down year → they sell in 2025 → 2025 becomes a down year → the 4-year cycle breaks.”

Exactly.

This is why I believe the 4-year cycle is dead—and why we’re entering a longer, bigger, liquidity-driven 5-year cycle.

The 4-Year Cycle Is Dead — Welcome to the First 5-Year Crypto Cycle

Here’s the truth most still refuse to accept:

This cycle had zero of the macro ingredients that powered every past parabolic phase.

Look at history:

-

2013 – explosive liquidity

-

2017 – explosive liquidity

-

2021 – explosive liquidity

But 2022–2025?

Nothing. Flatlined. Dead. Tightened to suffocation.

This cycle has not had its “liquidity boom moment” yet.

That moment is coming.

And the setup is unlike anything we’ve ever seen.

The Biggest Easing Cycle Since 2009 Is About to Begin

Here’s the part people are missing:

The world is preparing massive, synchronized, global easing:

-

U.S.: $2,000 stimulus checks

-

Japan: $110 billion stimulus

-

China: $1.4 trillion stimulus

-

Canada: restarting QE

-

Global M2: record $137 trillion

-

320+ global rate cuts in 24 months

-

The Fed ends QT in December

This isn’t tightening.

This isn’t caution.

This is the prelude to the next global liquidity wave.

And crypto—being the most reflexive asset class on Earth—will respond violently.

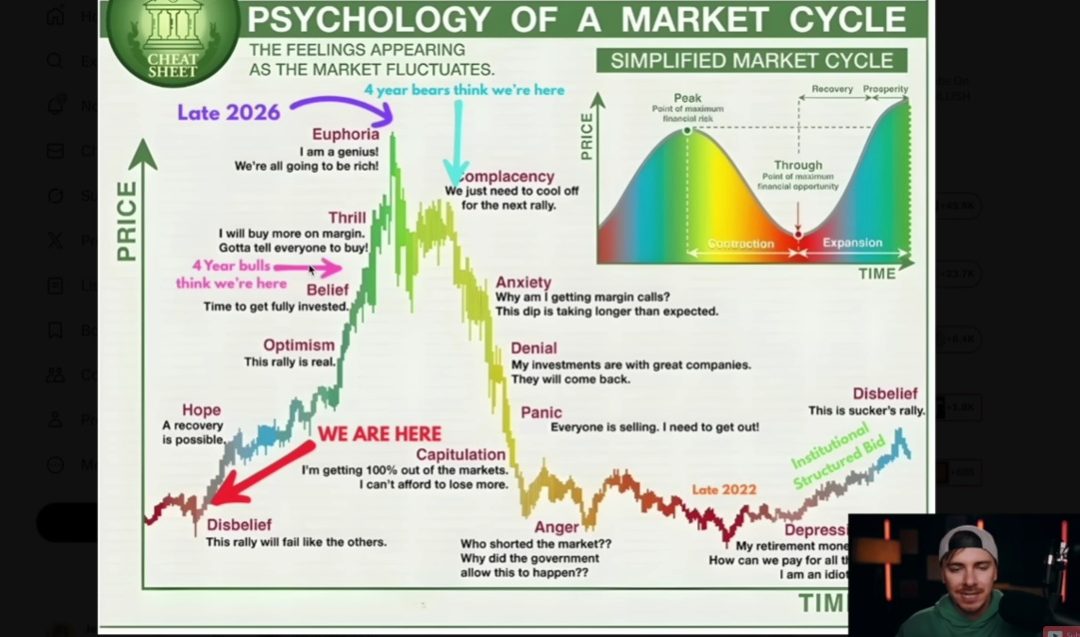

Why I Believe We’re Only in “Disbelief” Phase of the Market Psychology Chart

Based on everything above, here’s where I believe we are in the market cycle:

Disbelief.

The moment before the real markup phase begins.

The part of the cycle where only a handful of people have conviction.

In every cycle, disbelief precedes the most explosive gains.

And today, disbelief is everywhere:

-

Crypto Twitter is capitulating

-

Retail is absent

-

Influencers are despairposting

-

People are selling at local bottoms

-

Analysts are calling the top

-

Sentiment is the lowest since 2022

This is what the start of a real bull run looks like.

Why I Believe 2026 Will Be Massive (And Maybe 2027–2028 Too)

Here’s my stance, and it hasn’t changed—not in the good days, not in the crashes, not now:

I believe we are heading much higher into 2026.

I believe this cycle will extend beyond anything we’ve seen.

I believe the liquidity setup is the strongest since 2009.

I believe the “bubble” hasn’t even begun yet.

Could this run extend into 2027 or 2028?

Absolutely.

Cycles don’t end because of vibes—they end when liquidity dries up.

And liquidity is only just beginning to return.

My Conviction Comes From Data — And From Putting Everything on the Line

I don’t run ads.

I don’t take sponsorships.

I don’t shill tokens.

My money is where my mouth is.

If I’m wrong, I lose everything—my capital, my home, my reputation.

This isn’t a hobby take.

This is conviction backed by risk.

And I still believe:

The top is nowhere near in

2026 will be explosive

We are early in a multi-year easing cycle

Retail mania hasn’t even arrived

The real bull market is ahead, not behind

Final Thoughts (and a Disclaimer)

Nothing in this article is financial advice.

I’m not your financial advisor.

You must always do your own research.

But after studying cycles for a decade…

after analyzing liquidity charts daily…

after watching how institutional flow has shaped this early cycle…

I genuinely believe we’re standing at the start of something massive.

Not the end.

The beginning.

If this article was helpful, share it—

and buckle in.

The next chapters of this cycle are going to be wild.

Crypto Rich ($RICH) CA: GfTtq35nXTBkKLrt1o6JtrN5gxxtzCeNqQpAFG7JiBq2

CryptoRich.io is a hub for bold crypto insights, high-conviction altcoin picks, and market-defying trading strategies – built for traders who don’t just ride the wave, but create it. It’s where meme culture meets smart money.